The Compass SESAMm Crypto Sentiment Index is a diversified digital asset index designed to offer broad exposure to the market’s top crypto assets (all sectors included), while capping each component exposure at 30%. Weightings are based on sentiments scores, liquidity and market capitalization constraints.

Starting Universe:

- The 50 most liquid coins for which a Compass Crypto Reference Index exists

Components selection:

- Last minimum market capitalization is above 250 million USD

- 30 days rolling average market capitalization is above 250 million USD

- 30 days rolling median USD traded volume is above 1 million USD

- Keep the 20 components with the highest rolling average market capitalization

Weighting Definition:

- For BTC & ETH, weights are defined as: 2/3 Market Cap weights and 1/3 Volume-traded weights

- The remaining weight is allocated to the other coins based on their Sentiments weights

- Weights are capped at 30%

Rebalancing:

- The Index is rebalanced monthly on the first calculation of each month

The first-ever index to weight the top crypto currencies with a sentiment tilt

Integration of Artificial Intelligence

SESAMm’s NLP technology carries out a granular and transparent analysis of publicly available articles. More than 20 billion articles from over 4 million international and local sources are analyzed to identify each coin’s associated mentions. For each source, indicators of sentiment and volume of mentions are determined. These indicators are then aggregated daily to create a historical time series per cryptocurrency, which acts as the basis for the overall score used by Compass Financial Technologies. For each day and each coin, SESAMm calculates crypto sentiment scores based on several indicators such as polarity, volume and memory functions to provide up-to-date and representative scores.

SESAMm’s crypto sentiment scores are based on the sentiment scores (negative, positive and neutral) computed on articles related to the 50 digital assets universe.

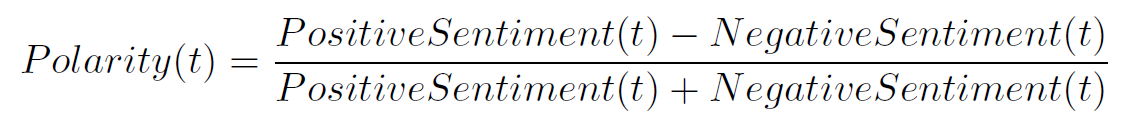

Polarity:

Negative/Positive sentiment (t): The average negative/positive sentiment calculated for day t for a given crypto. This daily sentiment is calculated by aggregating article-level sentiment.

Different variants of the score are created by varying several parameters:

- Memory: The crypto universe is much more volatile, as actions move faster compared to classical finance. We use a half-life of 7 days to weigh the importance of related articles for each token. A half-life of 7 days means that an article that is 7-days-old counts for 50% compared to an article published today.

- Volume: Weighting the sentiment by volume to highlight days with significant events.

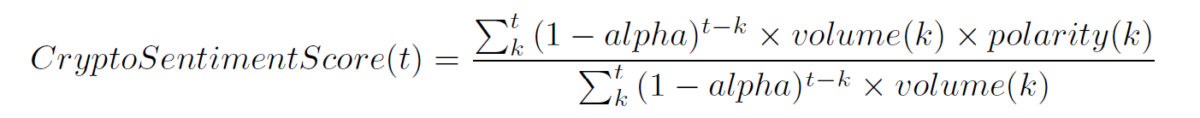

Crypto Sentiment Score:

- Volume(k): Number of articles related to the entity on day k

- Polarity(k): Average polarity of articles related to the entity on day k

- Alpha: Memory parameter

SESAMm is a leading artificial intelligence and NLP (natural language processing) technology company serving global investment firms, corporations, and investors, such as asset managers, banks, private equity firms, hedge funds, and index providers. With over 100 employees and six offices worldwide, SESAMm celebrated its 8th anniversary in 2022.

SESAMm analyzes all publicly available information on the web in real-time to generate insights and indicators for thematic investment, controversy detection, ESG risks, and positive impact scores, among others. SESAMm’s NLP technology carries out a granular and transparent analysis of more than 20 billion public documents available on the web from over 4 million international and local sources integrating all stakeholders’ opinions. Leveraging state-of-the-art technology and proprietary NLP algorithms such as Named Entity Recognition (NER), Knowledge graphs and sentiment analysis, SESAMm is helping its clients gather up-to-date information and enhance their investment decision-making process to create innovative strategies.

SESAMm generates meaningful insights on more than 70 million entities related to their thematic exposure, behavior and market perception, encapsulating all asset classes and regions.

SESAMm

Reveal critical insights from the web